Do You know?

A Private Limited Company means a company where minimum number of member is 2 and maximum 50. It is the most popular form of business entity among start-ups. There is no minimum capital requirement to start a company.

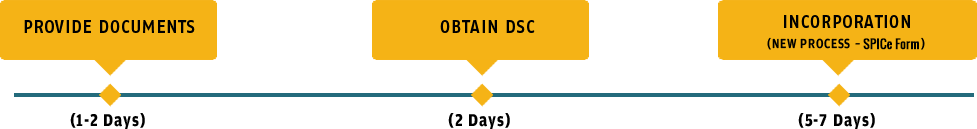

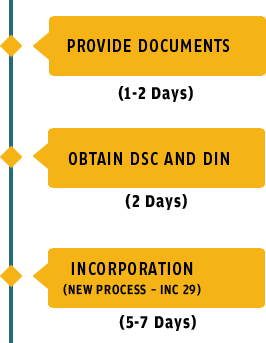

Under new process?.a company can be registered in 5-10 days. Form INC-29 is submitted to MCA with all the relevant documents. If the name is acceptable, MCA will issue incorporation. Else, resubmission with new name may be required.

- 1. Obtain DSC

- 2. Apply for Company Name Approval

- 3. Prepare documents ( DIR-2, INC-9, Declaration)

- 4. Get the signed documents

- 5. Obtain lease deed and Latest Electricity Bill

- 6. Prepare the SPICe Form

- 7. Prepare SPICe MoA

- 8. Prepare SPICe AoA

- 9. Submit forms for registration

- 10.Paying Govt Fee

- 11.Receiving Approval/re-submission

| Required for whom | Nature of Document/Information required | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|||||||||||||||||||||

|

|

about Company and company Incorporation

- What is DSC : DSC stands for Digital Signature Certificates. This is basically e-signature. This is required separately for each Shareholder/Director. This is required for submitting company Incorporation application as the incorporation forms are to be e-signed by the proposed Directors/Shareholders. These are issued in pen-driver form and are valid for 2 years. These are required for company incorporation as well as for post incorporation regular compliances of company. These are not transferable. These are password protected.

- What is DIN : DIN stands for Director Identification Number. This is unique number issued to every proposed Director. If a person wants to be appointed as Director in a company, then he must possess DIN.

- What is Minimum No of Shareholders: The minimum no of shareholders are Two.

- What is Minimum No of Directors: The minimum no of Directors are Two.

- Whether any qualifications are required to become a Director : There is no special qualification except that he need to Obtain DIN.

- What is Minimum Share capital to be taken-up by Shareholders : No prescribed Minimum Share capital and company can have even INR 1000 as paid up Capital of the company.

- Whether office required for registering the company: Company must have registered office In India in any State. It is mandatory for a company to have registered office with -in 15 days from the date of Incorporation. The premises can be residential or commercial. The documents required are Rent agreement between Company and owner (Rent agreement between Director and Owner is not valid), Latest electricity bill and NOC from Owner to use the premises as Registered office of the company. The shareholders/Directors can use their residence as Company address. In case you do not have premises for registered office, we also offer our office at a nominal rent for using the address as registered office of the company. The company can change its registered office address any time but the new address must be of the same state in which the company was registered. For example if the company has been registered in Delhi, then it can have new address in Delhi only. In case registered office is to be change to some other State, then approval from Company Law department is required which is lengthy and expensive.

- Whether physical presence of the Shareholders/Directors is required to register a company: No, there is no need of physical presence. The entire process is online. We shall email all the required documents in PDF format to you and you can take print of the PDF files, get them signed and email the signed scanned documents to us and that?s it.

- How much time it take to register a new company: It normally takes 7 working days to register a new company provided all the required documents are ready and Government approvals are received in normal time.

- How long the company is valid: A company is valid for Indefinite period provided all compliances are done regularly.

- Whether a person working as employee in any company can become Director: There is no such restriction in any law, but normally there are restriction in Employment Letters for not engaging in any other work/business.

- What is MOA : MOA stands for Memorandum of Association. It has to be filed with the Registrar of companies at the time of registering the new company. It has to be printed and made public to the Bank, Creditors or anybody associating with the company. MOA has the following clauses/information

- Name Clause ? This clause has the name of the Proposed Company.

- Registered office Clause ? This clause has the State in which the registered office of the company shall be situated.

- Object Clause ? This clause has the listing of the works to be done by a company after its incorporation. This clause has to be drafted very carefully as a company cannot do anything against that is mentioned in this clause. For example if you have mentioned under object clause that you will do real estate business then you cannot do any other business under this company.

- Capital Clause ? This clause has authorized ( Maximum) Share capital of the company.

- Association Clause ? This clause has names, addresses and occupations of first shareholders and number of shares taken by each shareholder.

- What is AOA : AOA stands for Articles of Association. It has to be filed with the Registrar of companies at the time of registering the new company. It has to be printed and made public to the Bank, shareholders and potential investors. AOA also establishes a binding contract between the company and the members and between the members. Articles are like partnership deed in a partnership. AOA, interalia, has the following clauses/information

- Allocation of shares among the shareholders and the manner in which these shares have to be handled i.e. lien/transfer/ surrender/conversion, etc.

- Voting rights of members

- List of Directors including first Directors, their appointment, remuneration, qualifications, powers and proceedings of Board of Directors? meetings.

- General meetings of shareholders and proceedings at general meetings.

- Board of Directors and their powers

- How accounts and audit will be managed

- Borrowing powers

- Certificate of Incorporation: This is a legal document certifying the existence (birth) of the company. This document is basically Date of Birth Certificate of the company. A company is said to have come into existence on and from the date this certificate of incorporation is issued by the company Law department.

- What is PAN : PAN stands for Permanent Account Number. It is issued by Income Tax Department, Govt. of India. PAN is a code that acts as identification for Income Tax in India. There are separate PANs for Directors and companies.

- What is TAN: TAN stands for Tax deduction Account Number. This is required when TDS is to be deducted from payments to be made to vendors.

- Whether it is mandatory to obtain GST registration: As per GST Law it is mandatory to obtain GST registration if Sales/ consulting receipts are more than INR 20 Lacs for year/period ended 31st March.

2015

All rights reserved. Adventus Business Services

2015

All rights reserved. Adventus Business Services