Do You know?

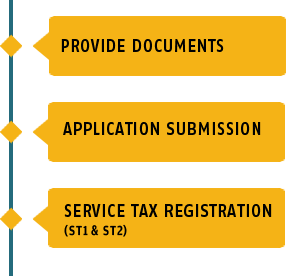

Service Tax Registration is required for businesses providing services in India. Service Tax is payable on services provided by the Service Provider. Service provider collects the tax from Service receiver and deposits with Central Govt. It is similar to Excise Duty which is paid by manufacturer of goods.

At present, Service Tax is levied at 14% on the value of the taxable service (w.e.f. 1 June 2015).

Service Tax registration is mandatory for every person or business in India that has provided a taxable service of value exceeding Rs.9 lakhs, in the previous financial year. Failure to obtain service tax registration would attract penalty in terms of section 77 of the Finance Act, 1994.

- 1 Self certified copy of PAN, (where allotment is pending, copy of the application for PAN may be given).

- 2 Copy of MOA/AOA in case of Companies

- 3 Copy of Board Resolution in case of Companies

- 4 Copy of Lease deed/Rental agreement of the premises

- 5 Latest Utility bill of the premise

- 6 A brief technical write up on the services provided

- 7 Registration certificate of Partnership firm / Partnership Deed

- 8 Copy of a valid Power of Attorney where the owner/MD/Managing Partner does not file the application

- 9 Power of Attorney in favor of the Consultant (POA)

2015

All rights reserved. Adventus Business Services

2015

All rights reserved. Adventus Business Services